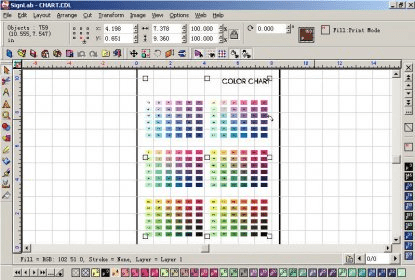

SIGNLAB 9.1 UPDATE FILE CODE

For example, the value of the K_15 JPK element is the net amount of all the transactions in the invoice that is related to the domestic supply of goods and services, where the applicable tax rate code is second level reduced rate. The system displays the net amount and tax amount for each group of transaction. This section includes all of the transaction lines in an invoice or voucher grouped by applicable VAT reporting fields (JPK elements).

SprzedazWiersz: Each invoice or voucher has a SprzedazWiersz section in the XML file. These are the sections specific to sales VAT register. See Section 6.2, "Information in the XML File Common to the Five Accounting Sections" for information on the header and legal entity sections. See also " Understanding Tax Rate Areas" in the JD Edwards EnterpriseOne Applications Localizations for European Reporting and SEPA Processing Implementation Guide. See also " Understanding Intracommunity VAT" in the JD Edwards EnterpriseOne Applications Localizations for European Reporting and SEPA Processing Implementation Guide. See Section 3.3.1, "Setting Up UDCs for Tax Processing". See Section 3.2, "Setting Up Tax Rate Areas". The system identifies an export transaction when the transaction is not a domestic or an intracommunity transaction. For example, when the amount in the Tax Rate 2 field is 16 and the amount in the Tax Rate 3 field is -16 in the Taxes table (F0018), the transaction is an intracommunity transaction. The system identifies an intracommunity transaction when the output tax is recovered by the input tax. The system identifies a domestic transaction when the country specified in the Alternate Tax Rate/Area by Country program (P40082) is the same as the country of the company in the Address Book program (P01012). Void transactions are not included in the XML file.

SIGNLAB 9.1 UPDATE FILE PDF

The system prints a PDF file listing all the invoices that are not included in the XML file due to incomplete setup or invalid processing option values. If you have not correctly set up the alternate tax rate area in the Alternate Tax Rate/Area by Country program (P40082), the system cannot retrieve domestic transactions and does not include them in the XML file. The Sales VAT Register XML file includes these sales transactions: domestic transactions, intracommunity transactions, and export transactions. IdentyfikatorPodmiotu header section is replaced with Podmiot1.ĪdresPodmiotu header section is not available.Ħ.3.1.1 Sales Transaction Types Included in the Sales VAT Register XML File Information regarding the address book number of the tax authority and currency of the company is not included in the Neglowek header. Note that for the Purchase and Sales VAT register:

SIGNLAB 9.1 UPDATE FILE REGISTRATION

The system prints the tax registration number without the country code as the prefix.ĪdresPodmiotu: This legal entity address section includes the address of the reporting company.Ĭompany address information includes Polish-specific data such as the post office location that is linked with the address zip code and can be different from the company address. Tax registration number of the reporting company IdentyfikatorPodmiotu: This is the legal entity identification section and includes the following: Naglowek: This header section includes the following: The XML file includes the header, legal entity identification, and legal entity address sections that are common to all the five accounting sections: You must also set up additional data and reconfigure the system to support all of the audit file reporting requirements.Ħ.2 Information in the XML File Common to the Five Accounting Sections

The system retrieves information for the five accounting sections from the existing tables. The files are sent directly to the tax authorities web page or through other electronic media (for example, DVD). For example, tax registers are run on tax period basis, invoices on GL period basis, and accounting data on GL period as well as annual basis to ensure completeness of accounting data. The EnterpriseOne system provides you five different programs to run each section of the XML file separately.

The tax authorities can request for partial delivery of any audit file section. The audit file must be produced in an XML format presenting accounting journals, tax transactions, bank statements, and inventory movements in the prescribed format and grouped into the following sections: Tax authorities may request historical data in traditional format if companies cannot deliver the audit documentation using the JPK file. The audit documentation must be in a prescribed electronic format called Jednolity Plik Kontrolny (JPK). 6.1 Understanding Unified Audit Files for PolandĪll registered companies in Poland must produce audit documentation on demand by the Polish tax authorities.

0 kommentar(er)

0 kommentar(er)